Nearly half of UK workers think they’re being paid less than they should be, according to new research by Ciphr

A new survey by HR software provider Ciphr suggests that most people don’t believe they’re being paid what they think ‘they are worth’ to do their current jobs. And, perhaps unsurprisingly, the longer it’s been since they last received a pay rise – then the more inclined they are to feel this way.

Ciphr polled 1,005 British adults to discover more about how employees perceive their pay. The findings reveal that less than half (41%) of workers consider their salary to adequately reflect their job role and experience. The other half (44%) think they’re being paid less than they should be, and one in six (15%) can’t decide one way or the other.

By comparing whether employees agree or disagree with the idea that they are paid ‘what they are worth’ to the last time they received a pay rise, the results appear to show a direct correlation between the two. Those that have waited over a year for a salary increase, are more likely (67%) to be dissatisfied with their earnings. While the majority (60%) of those who received a pay rise within the last six months think the opposite.

Notably, people occupying senior management positions, such as owners, CEOs, CFOs and C-level executives, are more likely to feel adequately rewarded for their efforts, with the majority (64%) agreeing that they are paid ‘what they are worth’. Two-fifths (40%) of them report getting a pay rise in the last six months.

Not so for non-management staff, however, who make up around 64% of survey respondents. They are among the most likely (48%) to think they’re underpaid and the least likely (33%) to have had a pay rise within the last six months.

While an employee’s perception of what they earn can be shaped by a number of different factors, such as job title, organisational role, and experience, for example, it can only really be quantified in monetary terms. Around £45,000 seems to be the sweet spot for most, which is significantly higher than the national average (according to the Office for National Statistics, the median annual pay for full-time employees in the UK is £31,461). Nearly half (48%) of people earning an income of over £45,000 think they are being paid ‘what they are worth’. On the flipside, 46% of those earning less than £45,000 don’t think they are being paid ‘what they are worth’.

Why don’t people ask for a pay rise more regularly?

Given that around two-fifths (38%) of employees say they haven’t had a pay rise in over a year, and around the same number (43%) say they haven’t requested one in over a year, it’s easy to question why so many people have accepted the status quo? This poll doesn’t provide a definitive answer to that, but it does perhaps illustrate the maxim: if you don’t ask, you don’t get.

Workers at smaller companies (with 26 to 50 employees) seem the least likely to request a pay rise, with only 50% having done so within the past year, compared to 55% of those at larger organisations (with over 251 staff).

Women also seem less likely than men to request a pay rise, with only 54% compared to 60% having asked their employers for a raise within the past year. When it comes to getting one, slightly more women (63%) than men (60%) actually got a pay rise.

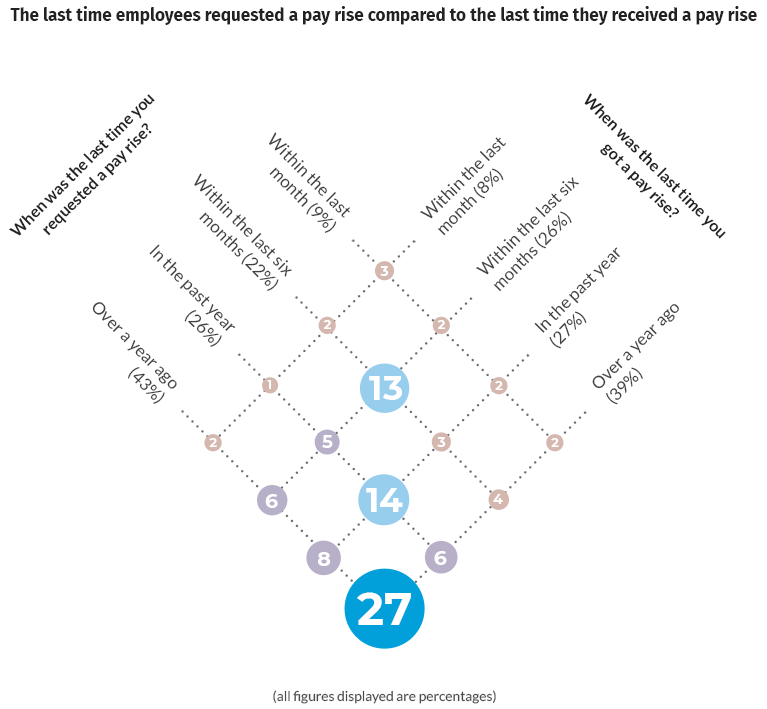

To find out how many people were successful in negotiating a salary increase, Ciphr compared the last time employees requested a pay rise to the last time they received a pay rise. A third (33%) of the employees who requested a pay rise within the last month, got one in the last month; two-thirds (68%) of the employees who requested a pay rise within the last six months, got one in the last six months; and three-quarters (77%) of the employees who requested a pay rise within the past year, also got one in the past year (most – 54% – around the same time they asked for one).

The majority (63%) of survey respondents that say they haven’t requested a pay rise in over a year, haven’t got one in over a year. Only a third (37%) bucked this trend. So, perhaps for employees, it does pay to ask.

It certainly pays to be prepared, according to Gwenan West, head of people and talent at Ciphr: “Before you even contemplate asking for a pay rise, ask yourself ‘why’. Do you feel undervalued? Are you paid significantly less than the market rate? Have you taken on more responsibility?

“Research is key, and you need to be professional and strategic in your request. Plan out what you want to say in advance, have some notes at hand to refer to, and try to avoid emotive language.”

“What’s the worst you could be told – no?”, adds HR consultant Courtney Thompson-Ayerst, implementation team lead at Ciphr. “Having an open discussion is always the best way to approach a pay rise. Many employees look outside of their organisation as a form of negotiation, which can sometimes end in the wrong outcome. When, in fact, all that was needed was a simple conversation with their employer. It can make all the difference between feeling valued in the job you’ve got and (hopefully) earning what you want to earn – or, the alternative, feeling resentful and undervalued at work.”

Average annual pay rise was 8.8%

Across all respondents who report receiving a pay rise in the past year, the average increase was 8.8% (the median pay rise was 3%). The average pay rise for those that were awarded one over a year ago, was nearly 3% lower, at 6.2% (the median pay rise was 2%).

People working in the arts, entertainment, or recreation (77%), manufacturing (71%), HR (70%), finance and insurance (69%), legal services (67%), and retail (67%), were among the most likely to report getting a pay rise in the past year.

Commenting on the findings, Claire Williams, director of people and services at Ciphr, says: “Any questions around pay – particularly those that centre in on thoughts and feelings about ‘what you are worth’ as an employee, are always highly subjective. Salary is incredibly important in the most basic sense – in the main, employees want to feel financially rewarded for the skills or experience that they need to do their job effectively, the contribution they make, and essentially, for survival.

“There’s no denying that people’s perception of their own value in the workplace is closely linked to the financial package they receive. This has obvious implications for employers. Workers that feel undervalued or underpaid can have a negative impact on productivity, employee engagement, job satisfaction, morale and so much more.

“However, while salary is a key driver for many employees, there is a huge amount of research that suggests salary isn’t one of the top motivators to leave an organisation. Most people leave due to career and development opportunities, management behaviour, and work-life balance. Employers need to ensure that they take a wholistic approach when considering how best to retain and reward their top talent. Pay rises and market-value salary are important but they are only part of a wider set of retention methods to ensure employees feel valued and happy.”

The results from Ciphr’s latest survey (conducted on 23 September 2021) are available to view at www.ciphr.com/survey-are-you-paid-what-youre-worth.

Ciphr is a specialist provider of SaaS HR, learning, payroll and recruitment software through its HCM platform, Ciphr Connect. More than 600 organisations use Ciphr’s solutions globally across the public, private and non-profit sectors.

For more information, please visit www.ciphr.com.

###

Media enquiries:

Emma-Louise Jones, digital PR manager at Ciphr

e: ejones@ciphr.com

t: 01628 244206

David Richter, director of marketing at Ciphr

e: drichter@ciphr.com

Website: www.ciphr.com

Twitter: @CiphrHRSoftware

LinkedIn: www.linkedin.com/company/ciphr

Notes:

Ciphr is a specialist provider of SaaS HR, payroll, recruitment and learning software through its HCM platform, Ciphr Connect. Ciphr’s cloud-based solutions help busy HR teams to streamline their processes across the entire employee lifecycle and spend more time working strategically.

Ciphr Connect enables seamless integration, not only with Ciphr’s own solutions, but also to an ecosystem of specialist, third-party tools using its modern API technology.

Ciphr is a privately held company, headquartered in Marlow, Buckinghamshire. Over 200 employees work across the group, which includes Ciphr, Digits Industries and Payroll Business Solutions (PBS).

More than 600 organisations use Ciphr’s solutions globally across the public, private and non-profit sectors, with customers including Blackpool Pleasure Beach, British Museum, Cambridge Building Society, Cera Care, Claire’s Accessories UK, Dragon School, Envision Virgin Racing, Information Commissioner’s Office, Kido Education, Met Office, Pro:Direct Sport, The National Gallery, The Royal Society of Medicine, Thorntons Law, Vodafone Automotive UK, Volkswagen Group UK, Walsall Housing Group, and Willerby.

Ciphr spokespeople are available to provide expert media comment on a broad range of topics, including HR strategy, people management, employee experience and wellbeing, the future of work, tech trends, business and leadership, learning and development, and more.

.jpg?width=2121&height=1414&name=iStock-932342408%20(2).jpg)