The cost-of-living crisis may not be making headlines like it once did, but the impact of increased prices, double-digit inflation and falling 'real' wages is still taking its toll on millions of people in the UK.

Almost everything – from food and fuel to rent – has got more expensive over the last few years. Although the annual inflation rate has slowly eased since October 2022 (down from 11.1% to 2.2% as of August 2024) the cost of living remains exorbitantly high for a large share of the population. And, many people's earnings still haven't caught up.

Ciphr commissioned a survey of 2,000 nationally representative UK adults to find out how people are being affected by rising / high living costs in 2024.

Over half (54%) of the 2,000 people polled say they have felt stressed or overwhelmed at times because of increases in their cost of living.

One in two (51%) has cut their household spending this year, and around one in eight (13%) have reduced, or cancelled, insurance policies, such as income protection, car, home, pet, dental or health coverage.

One in five (21%) has struggled to pay bills or buy food this year, and one in four (23%) has run out of money before their 'pay day' (wages, benefits, pension or equivalent).

One in four people in the UK has run out of money before payday arrives

This includes 28% of employees, 36% of people who are unemployed, and 42% of students

How is the cost-of-living crisis impacting UK workers?

People across the UK may share similar concerns when it comes to the ongoing cost-of-living crisis, but not everyone is affected equally.

Some of the key employee findings from Ciphr's 2024 cost of living survey include:

- Over half (52%) of employees have cut their household spending

- A fifth (20%) have requested a pay rise – this rises to 33% among employees under 35

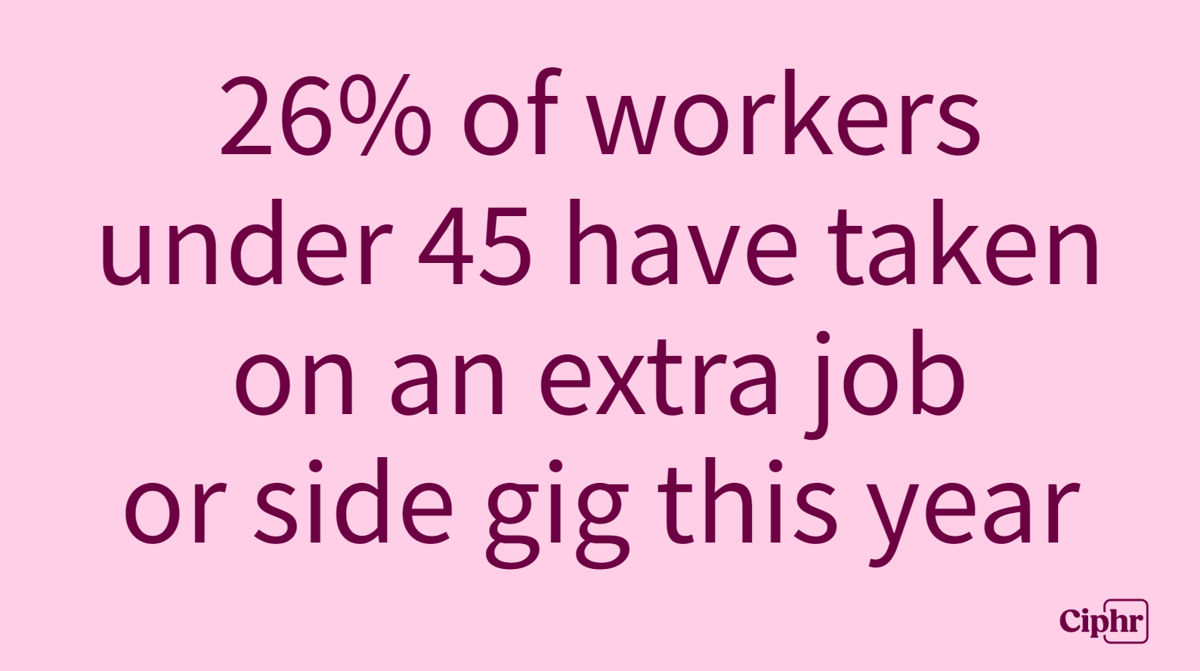

- One in six (17%) has taken on an additional job or side hustle

- One in seven (15%) has recently changed employers (for a better paid job)

- And, a quarter (26%) of the UK's workforce have been actively job hunting for higher-paying roles

Reducing outgoings and boosting pay only goes so far, though. For many workers, their earnings still don't stretch far enough.

Since January 2024:

- Over a quarter (28%) of surveyed employees say they have run out of money before their scheduled pay day

- Nearly a quarter (23%) have struggled to buy food or pay their bills at least once (or more) this year

- One in seven (14%) has taken out a loan or additional loans

- Fear of losing wages saw one in four (29%) work through illness because they couldn’t afford to take unpaid sick leave (or statutory sick paid leave) to recover

- Two-thirds (66%) of female employees and half (49%) of male employees have felt stressed or overwhelmed by cost-of-living challenges. Women are also more likely to say they feel stressed every day (14%, compared to 9% of men)

- One in seven (15%) employees aged over 55 has postponed their retirement due to financial pressures

The chart below highlights how employees have been impacted by cost-of-living increases this year.

One in five (20%) employees has taken time off work this year due to financial stress

How are cost of living increases impacting different generations of UK workers in 2024?

Based on Ciphr's findings, workers at the beginning of their careers (and, likely, on comparatively lower salaries than most other survey respondents) appear to be among the most affected by cost-of-living pressures.

Employees aged 34 or younger are the most likely to have taken on more debt (via a loan or additional loans), and to have cut back on their pension contributions and/or insurance cover. They are also the most likely to have moved in with friends or family to save money.

Since January 2024:

- Two-fifths (40%) of 18-34 year olds, a third (34%) of those aged 35-44, and a quarter (23%) of those aged 44-54, say they have run out of money before their pay day at least once this year (compared to 10% of over-55s)

- Nearly a third (30%) of employees under 45 years old have struggled to pay bills or buy food this year (compared to 15% of over-45s)

- Over half (55%) of 18-24 year olds, and nearly two-fifths (38%) of 25-34 year olds, have worked through illness to avoid losing wages

- Nearly one in three (31%) 18-24 year olds surveyed have asked to receive their wages early via an earned salary advance scheme or an income streaming service, compared to just 3% of over-45s surveyed

- Over a quarter (28%) of workers aged over 65 have postponing their retirement due to the cost-of-living crisis

Around a third (38%) of employees under 45 years old have attended work when they were sick to avoid losing wages

Younger workers are the most likely to report having worked through illness this year. Over half (55%) of 18-24 year olds, and nearly two-fifths (38%) of those aged 25-34, have gone to work (or worked remotely) when they were ill because they couldn't afford not to

Cost of living survey results 2024: by industry

Ciphr’s researchers also analysed the survey results by industry:

- One in three people working in sales (37%), business and management consulting (37%), hospitality and events (35%), and IT (32%), are likely to switch jobs this year (if they haven’t already)

- Respondents working in energy and utilities, business, consulting and management, and hospitality and events, are the most likely to say that they have run out of money before payday (44%, 43% and 39% respectively). These industries are also among the most likely to have staff attending work while sick. For example, 40% of people in hospitality and events say they have worked through illness to avoid losing wages

- People working in science and pharmaceuticals, social care, creative arts and design, and teaching and education, are the most likely to report that they have felt stressed about high living costs (87%, 70%, 70% and 68% respectively)

- Two-fifths (44%) of employees say they have received a pay rise this year (to date). The workers most likely to have received a raise include those in energy and utilities, the charity and voluntary sector, and sales (56%, 53% and 53% respectively). The people least likely to have received a salary increase include those working in creative arts and design, healthcare, retail, and teaching and education (30%, 33%, 34% and 34% respectively)

Notes

Ciphr commissioned OnePoll to conduct an independent survey of 2,000 UK adults (nationally representative by age, gender and region). The survey ran between 31 July and 5 August 2024.

Nearly two-thirds (62% or 1,238) of respondents are currently employed, 5% are self-employed, 5% are unemployed, 3% are students, 4% are homemakers, and a fifth (21%) are retired.

Questions asked in the survey included: Which, if any, of the following have you done over the last six months (since January 2024) due to increases in your cost of living / rising living costs? (yes, no and n/a answer options were available)

This infographic was first published in June 2022. The survey data and findings were updated in June 2023 and then October 2024 for accuracy.

To read the key findings from the 2023 survey:

Two in five employees are working extra hours as cost-of-living crisis bites

Majority of in-person staff can’t afford to take time off for illness, survey suggests